A Look At The Reasons That Make Classic Cars The Best Collectible Investment!

The look for extra option resource classes has prompted expanded consideration and interest in land, products, universal value, and flexible investments. These optional resources have been generally investigated and talked about in budgetary writing in the course of recent years. We can express that the classes of optional resources of the past have turned out to be customary resource classes of modern days.

More...

Generally new classes of optional resources have not been considered broadly. Exchanging outflows, or interests in collectible articles are great cases of new classes like classic cars. A classic car is characterized as a vehicle over 40 years of age, which owners of the vehicles drove after the beginning of 1976 while collectible is a thing that is worth much more than it shows up in view of its irregularity or potentially request, for example, classic cars.

1. Huge Profit Returns on Classic Cars

Collectibles is an investment as we know, and probably everybody has heard the stories about immense benefits made on collectibles, from classic cars to jugs of vintage 'first development' and Bordeaux wines and so forth.

How Would You Go About It?

Take Jon Hunt for an instance, the originator of Foxton's Estate Agency, who sold the organization at the height of the pre-credit emergency lodging blast, and purchased a Ferrari GTO 250 for an eye watering £15.7 million. He sold it three years after for £20.2 million.

Does the Profit Worth It?

Not an awful return for a deteriorating resource sitting in a carport! Substitute the car for a Van Gogh, Penny Black, a Stradivarius or Patek Philippe watch and the stories are much the same. Late feature snatching benefits have unavoidably expanded financial specialist centre without a doubt, collectible resources in this aspect include melodic instruments, craftsmanship, and classic cars amongst others.

2. Collectibles As An Investment Strategy

Purported enthusiasm contributing to distribution of riches towards high esteem directions. Collectibles has been around for almost 10 years and is presently venturing into the exemplary car field. Classic cars are getting recognised because of their almost 500 percent returns over the previous decade, outpacing workmanship and wine by more than 100 percent.

The Most Elective Resources to Store Riches

Classic cars deals are on the ascension locally as extravagance utilization tendency increases and affluent purchasers look to elective resources to store their riches. Master merchants are revealing blasting interest for great and vintage automobiles, with a few shops announcing year-on-year turnover development of 30 for each penny amid the previous five years.

3. Collectible Takes Over The Globe

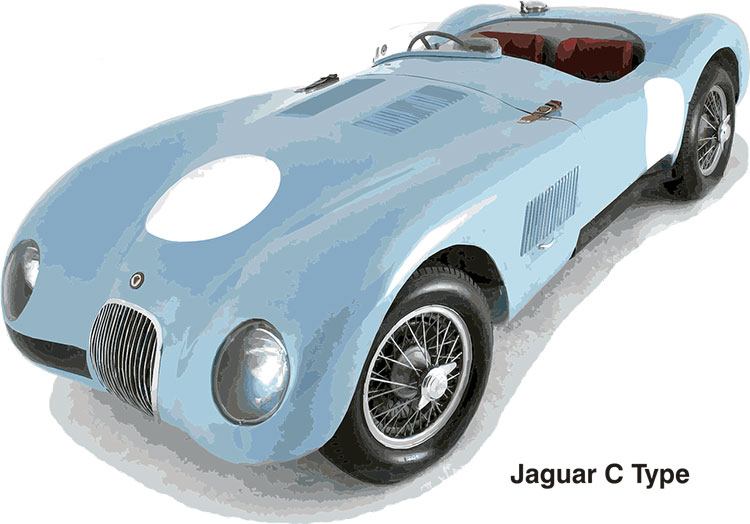

Classic cars around the globe are getting eye-watering costs, including a Jaguar C-Type drives lightweight from 1953, which sold for $US13.2 million ($17.1m) in Monterey, California in August a year ago. Nearby gatherers are additionally encountering an uplift in values.

Individuals from Australia's Ferrari Club have encountered capital development of more than 300 for every penny in five years on a few cars, including an early Ferrari 208 GTB, which retailed for around $70,000 five years prior, and is presently getting a charge out of valuations of more than $300,000. Different cars marques are posting the same sweltering additions.

4. Modern Super Cars Joining The Vogue

E-Type Jaguar Series 1s from 1961 to 1966 have multiplied their incentive in the previous five years, as per Shannons closeout supervisor Chris Boribon, while Porsche 356s from the 1960s to the 1980s have additionally performed well. Automobiles in Porsche's 911 territory from the mid-1960s to the mid-1970s are presently bringing as much as $300,000 each.

Do the Clients Still Want Old Fashioned Cars?

Present day supercars from the 1980s, including the Lamborghini Countach and the Ferrari F40, are additionally in vogue. The better picks up are provoking a bigger number of financial specialists than swing to the advantage class when share development is negligible and security rates have smoothed.

Clients are motoring lovers, yet the capacity to buy classic cars that are over 30 years of age delegated ''old fashioned vehicles'' without paying stamp obligation or capital additions impose likewise makes the vehicles a special alluring venture.

5. Hunger For Classic Cars Keep Growing

As indicated by Ferrari Club president Michael Rensch, "I don't see individuals getting to be automobile enthusiasts on the premise of the capital additions potential, yet it unquestionably makes it less demanding to legitimize the purchase of a car". He additionally say "owners in the club for the most part got them since they were occupied with automobiles, and they happened to go up in cost".

Few Reasons Why the Market Value Goes Up

Extravagance showcases around the globe are encountering a restored wave of venture, boosting offers of renowned property, uncommon coins, and Chinese pottery and other unmistakable extravagance merchandise. The rising tide of spending is lifting values in many markets.

In spite of progressing worrying financial conditions in many developing markets, the hunger of rich authorities hasn't decreased. On the off chance that anything, amid times of monetary instability, numerous affluent causing people to search for substantial speculations will be acknowledged in admiration.

6. Components That Influenced Classic Car Value As Collectible Investment

Collectibles can be portrayed as people who energetically (even fanatically) scan for and purchase one of a kind things or some likeness thereof. Regularly, these things have low inborn incentive in connection to their offering cost.

Utilization of Esteem Qualities

By utilizating esteem and target qualities, costs are driven by shortage and enthusiastic variables. In this way, it is nothing unexpected that collectibles are regularly alluded to as enthusiastic resources. The used amount of collectibles gives the owner higher utility as far as tasteful esteem is concerned.

Although money related advantages may not generally have been the basic role for securing collectibles, numerous authorities additionally seek after monetary profits.

7. Shortage or Scarcity of the car

The 4 RTA is a long way from being the most costly automobile as of late. That award goes to a red 1957 Ferrari 335 Sport Scaglietti, sold in Paris for €32m (more than £25m). It was one of four made, yet given that it came next at the 1957 Mille Miglia, set a lap record at Le Mansand and was driven by Stirling Moss, it may all be precisely judged as being one of one.

Classic Cars as a Long Live Dream

The market is an issue of era, you need to possess the car that was a fantasy for you when you were a kid. For instance, the Aston Martin DB6 (created from 1965-70) is practically proportionate to its antecedent DB5 show (1963-65), but for the broadening of the lodge space.

Aston Martin DB6 and DB5

Via pistonheads.com

The two automobiles share a similar engine, gearbox, back hub and body outline. However while a perfect DB6 now sells for more than £400,000, a proportional condition DB5 will change hands for twofold that sum.

Via commons.wikimedia.org

This is somewhat because of more DB6s than DB5s being produced, however the most persuading clarification is James Bond: particularly Gold finger, additionally the car's various reality trips amid the Pierce Brosnan and Daniel Craig years, and perhaps even those small model DB5 toys that present buyers may well have been skilled in their childhood.

Enthusiastic Resources

These classic cars speak to an exceptional resource class part speculation, part thrall to car workmanship and part youth dream. It is an avenue to own a dream car that can be afforded as a teenager.

8. Downsides Of Interest In Collectibles

When putting resources into collectibles straightforwardly one can experience a few troubles. Some of these issues are harder to overcome than others. The troubles come in form of the following situations

- Initially, collectibles are not extremely fluid. Since there is no fluid market, it is difficult to exchange positions in collectibles in a split second. With a specific end goal to offer, one needs to discover a merchant, a closeout house or a private purchaser.

- illiquidity is probably going to increment amid monetary downturn, due to the diminished exchanges (costs not meeting save). Risk unwilling investors might want to be made up for this risk as far as higher expected returns. Since it is difficult to gauge the span of the illiquidity risk, the same goes for the coveted risk premium.

- Besides, collectibles don't create money streams. Collectibles don't pay out profits, intrigue or lease like other monetary resources. Profits are based for value changes.

9. Why Do People Go For Collectible Classic Cars?

Like it has been discussed before in this text, collectible is taking over the world, and classic cars are one the biggest resources trending on this line, below is the reason why people go for collectible classic cars and you would see why it definitely worth it.

Costs of Classic Car Ownership

Classic car proprietorship brings particular expenses and advantages with respect to different speculations. The duty treatment is for the most part kind. In the last Budget, great cars were for all time exempted from UK street assess. On the off chance that the car is foreign made from an EU nation, it won't be liable to UK import obligations.

Given that VAT has been paid in the nation of root and it has more than 6,000km on the clock, at that point no import VAT will be expected, from outside the EU, UK obligations and different expenses may apply a noteworthy favourable position for those owners; To delineate their class in the general public and mostly to serve as methods for venture.

10. Conclusion!

In general, putting resources in collectibles is quite lucrative than putting resources into stocks. In the course of recent years, the Knight Frank Luxury Index is up 182% whereas Dow Jones is up 62%. At the point when all terms and conditions are met, the normal investor ought to likewise be an aficionada.

The $38 million dollar Ferrari amongst other classic cars too have a tendency to twist the genuine investment opportunity on other classic automobiles. Particularly with regards to American classic cars. Finding out the cost of restoring a classic car, holding on to it for a long time would definitely be the only choice for you as you are guaranteed to break even or make profit.